As you become more familiar with the benefits of a balance transfer, you may decide to learn more about the overall process. It’s the knowledge you collect here that helps you determine what to do next.

Fortunately, credit card companies have made it easy to complete a balance transfer. Here are a few things you need to do:

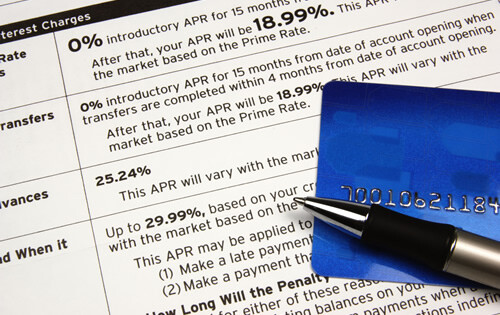

- Decide on a balance transfer offer. With so many of these to choose from, this is step number one. Compare a minimum of three offers to ensure that you’re making the right selection. Don’t forget to pay attention to the balance transfer fee.

- Share the appropriate information. When applying, you’ll indicate the following: amount of debt you want to transfer, account numbers associated with current credit cards, and who exactly you needto pay.

- Let your credit card company get to work. It’ll take some time – typically one to two weeks – for your new credit card company to contact your current creditors and pay them the amount you indicated on yourapplication. During this time, stay in touch with your credit card company to share any additional information that may be required along the way.

- Keep up with your payments. If you have credit card payments due before the transfer is complete, be sure to pay them by the due date. Neglecting to do so can result in a late fee, and that’s notsomething you need right now. If you have any questions about whether or not you should pay, ask the credit card company where things stand with the process.

These may not be the only steps you take when completing a balance transfer, but knowing the basics will help you stay on track from beginning to end.

Once the process is complete, you’ll find yourself in a better spot. You can then devise a plan for eliminating your credit card debt once and for all.